Investor FAQ

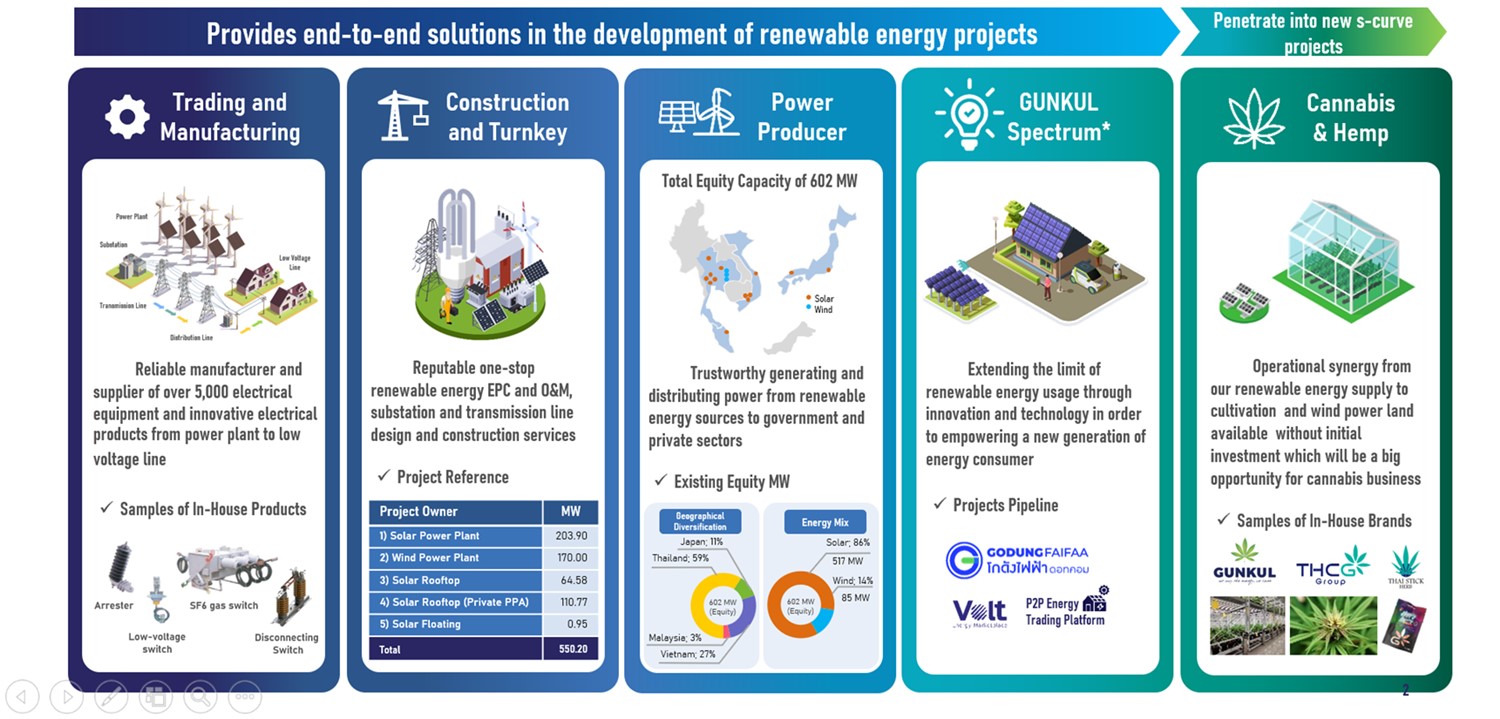

Currently, the company's business can be divided into 5 groups as follows:

1) High Voltage Equipment Business

Produce, procure, and sell equipment for electrical systems, power stations, including medium to high-voltage transmission lines, grounding equipment, equipment for power transmission line system, lightning products, and alternative energy products, both domestically and internationally.

2) Construction Business and Turnkey

Provide comprehensive engineering, maintenance, procurement, installation, and construction services for renewable energy power plants, power stations, transmission lines, grounding system, submarine cable, microgrid system, energy storage system, and related intelligent device systems.

3) Renewable Energy Business

Produce and distribute renewable energy business both domestically and internationally, comprising solar, wind to reduce greenhouse gas emissions and raise the level of solving climate change problems.

4) GUNKUL Spectrum Business

Focus on developing an ecosystem business platform that incorporates new technologies to create business value and providing the Company and business partners opportunities to expand beyond their boundaries in order to enhance the potential of expanding customer base. Additionally, there are also a supply of products and services to fulfill the needs of each party, to consulting services on suitable renewable energy, as well as, exploring new channels to strengthen the business to become sustainable leader in energy business.

5) Cannabis Business

Increase opportunities and create additional value for the business by continuing the original potential basis by growing hemp and cannabis in a greenhouse system. It is the highest quality control. We run the business professionally to enhance quality of life, for maximum benefits to clients and Thai people.

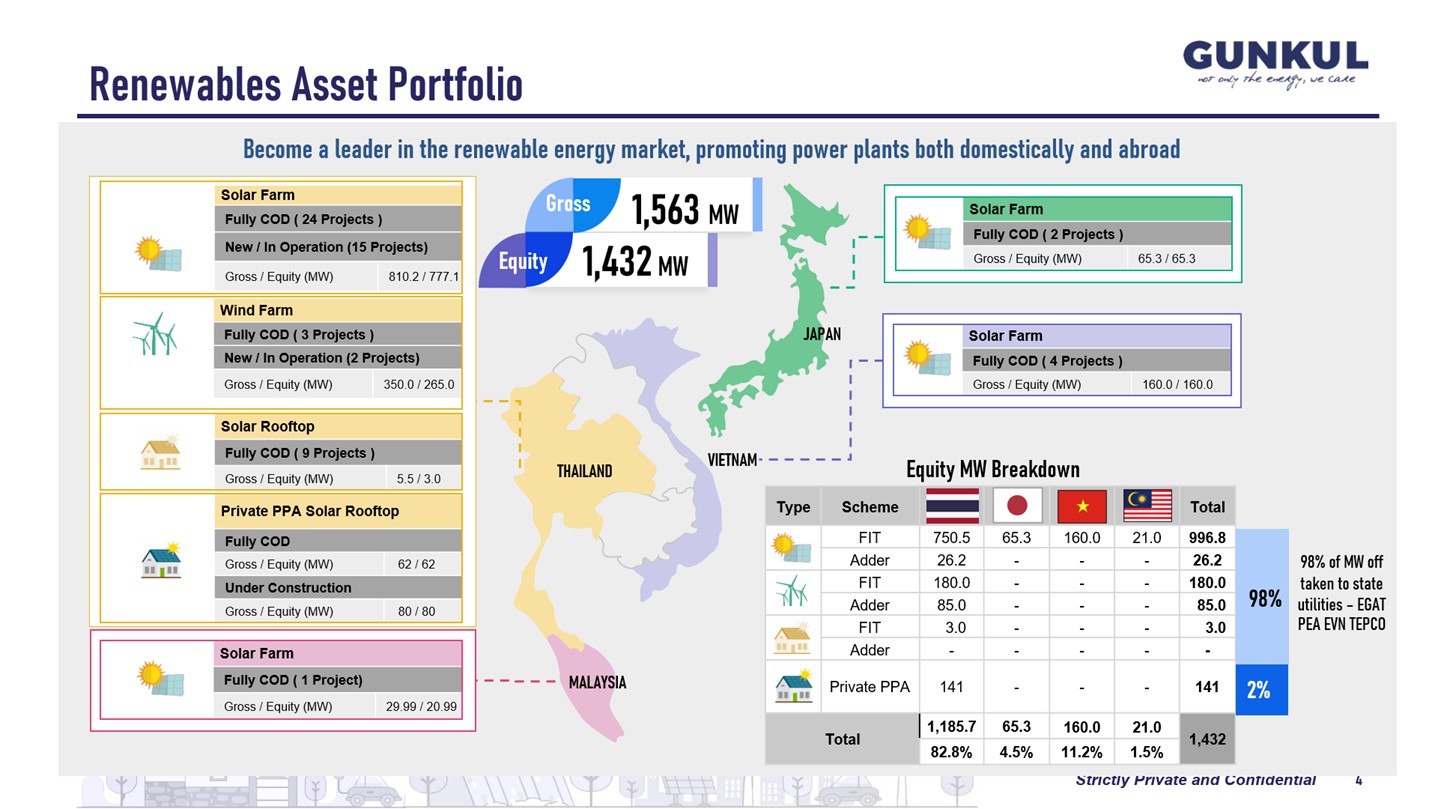

The company has a total electricity generating capacity of approximately 1,432 Equity MW, details as below.

The company has an entire operation from upstream to downstream, with a various portfolio of power plants. In the future, the company is planning to grow the business by Joint Ventures with the well-known/leading company to strengthen the company's strength.

According to the latest Power Development Plan policy that encourage the clean energy, an increase of approximately 8,866 megawatts. This is a positive impact on the energy group's portfolio including the group of construction & Turnkey business and High Voltage Equipment Business.

The company has a rating from TRIS Rating with the recent review which was announced on March 31, 2023 at the level of " BBB+" with a rating of " Stable". The credit rating still reflects the stable cash flow from the electricity business. Along with strong competitiveness in the electrical equipment business and the advantage of operating a fully integrated business or vertical integration of the company. The rating also considers the company's reduction in debt levels, which has helped increase its finance capabilities to support new investment opportunities as well.

The company has a policy to pay dividends of not less than 40 percent of net profits according to the company's financial statements after deducting corporate tax, Legal reserve, and other reserves. However, the Company may specify the dividend payment rate be less than the rate specified above. Depend on working capital needed for operations, business expansion, and other factors involved in the company management.